Still in the age of AI and boom of various innovative jobs/ business prospects, parents have dreams of seeing their wards as Doctors/ Engineers/ Management Grads…

This article is not to scare such proud Parents of their brilliant wards, but to make them aware and be prepared of the escalations in education costs for fulfilling their dreams rather than getting destroyed during course of treacherous life of loans and EMIs.

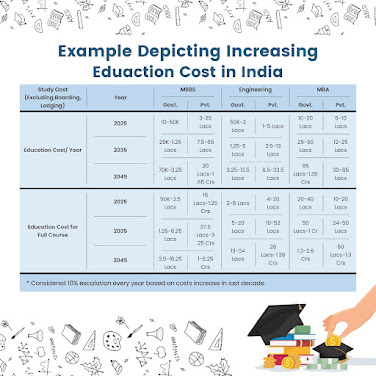

I did some googling and found interesting facts about Education Cost Prediction for MBBS, Engineering and MBA courses in India.

Predicting education costs for the next 20 years involves considering various factors like inflation, demand for higher education, and institutional expenses. Here's a breakdown of potential costs:

MBBS

- Current cost:

- Government colleges: ₹10,000 to ₹50,000 per year

- Private colleges: ₹3 lakh to ₹25 lakh per year

- Predicted cost in 20 years:

- Assuming an annual increase of 10% (as seen in the past decade), the cost of an MBBS degree could rise to ₹25K to ₹11 lakh by 2035 (considering range of government and private institutions). Extrapolating this trend, the cost could potentially reach ₹70K-1.65 Crs by 2045.

- And this is just one year cost, extrapolating for full year course, cost can reach to as high as 8 crores.

For better understanding of the cost escalation, kindly refer the attached table for ready reference. Please note these costs are purely indicative, illustration purpose only and may vary from cities, type of institutions and many other external factors.

Factors Influencing Education Costs

- Inflation: Rising costs of living, faculty salaries, and infrastructure development contribute to increasing education expenses.

- Demand for Higher Education: Growing demand for quality education leads to higher costs as institutions invest in better infrastructure and resources.

- Government Policies and Regulations: Initiatives to regulate fee hikes and provide financial support can impact education costs.

Million rupee question is, Are Parents prepared for this escalations costs and how can one beat inflation. be financially prepared rather than stay Bhagwan bharose…

Planning for Future Education Expenses

To manage rising education costs, consider the following strategies:

- Start saving early: Take advantage of compounding interest to mitigate the impact of education inflation.

- Explore investment options: Just as you nurture your child, create another child in form of Education Specific SIPs in Mutual Funds.

There is no other option than to start investing Early & For Long Term to reap benefits of Compounding & fulfilling our dreams.

Below example through creatives is self-explanatory how small amount of SIPs for long term can generate desired wealth.

Demand for education will invariably increase in future and so do the costs, Lets be prepared financially to be victorious in our quest for fulfilling our children’s dreams.

Regards

Keyur Gandhi

Chief Executive Officer

Clarion Insurance Broking Services Pvt. Ltd.

M: +91 98254 04014, +91 99308 74014

Email: keyur.gandhi@veritasins.com, keybgandhi@yahoo.co.in