Studies say toddlers ask about 300–400 questions per day. Mothers ask about 100 but can go up to 300. The older people ask less but since they can answer a lot of questions because of their experience it makes sense, tajurba bolta hai, sunta nahi. Those under 7 will always ask the most questions however after that age, shyness kicks in and fear of being made fun of, for not knowing the answer, Teens probably ask the least.

My estimate for the number of questions per average person per day would be about 20.

When it comes to Finances, generally a common man avoids Questions, may be due to fear of ignorance, considers it not important or just we can talk about it later.

Pandemic like Covid-19 has raised ample questions in our minds regarding our Finances. Thus, it’s not too late to ask questions regarding our Financial well-being.

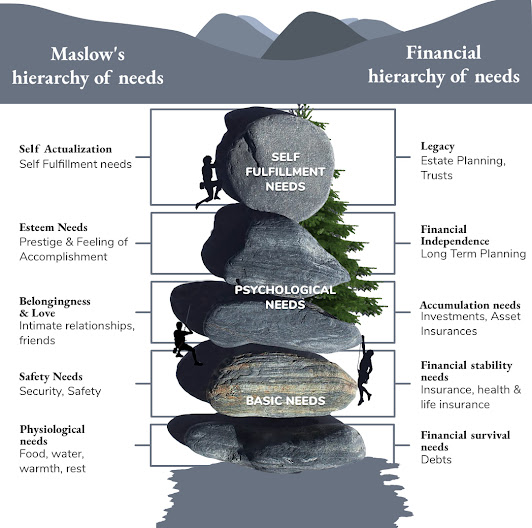

It can’t be more apt to start our conversation on Finances, than with Maslow’s Hierarchy of needs studied during my post-graduation days which had been and is currently the most important Life law which starts with our Basic needs to fulfillment of Self-actualization.

Coming from the concept of Jaan hai to Jahaan Hai, may be, we Indians have taken our basic needs too seriously and forgotten about our Financial needs and thus have stopped asking questions about our Financial Physiological & Safety Well-being.

Thus, with the core agenda of bringing Financial awareness and Financial Inclusion of all, I start with this Article of Questions.

Read it, like it & Forward it…Itna to banta hai Boss…

Most of us grow-up financially ill-literate, disorganized, however if you are reading this article and have reached to this para, bade aadar se kah raha hun, you are a well-educated person and seem interested in your financial well-being.

Let’s draw a parallel Financial Hierarchy of Needs to that of Maslow’s & ask a pertinent question to ourselves as to where we are on the ladder of Financial needs…

At the bottom of the pyramid, the first human needs that have to be met are those necessary for human survival (e.g., water, food, etc.). Roti, Kapda aur Makaan

Once a person’s physiological needs are met, focus then turns to safety.

Its obvious that safety is less important if you don’t have fresh water to drink or food to eat, so you do need to focus first on finding water than getting a cozy place to protect yourself from predators.

That doesn’t mean you’re not on the lookout for hiding places or shelter when you’re searching for water, it just means water is your first priority and the other things are less important.

Human-being, a Social animal always desires for Love and belongingness. Most of us like to live in a society rather than on Himalayas and once we are done with our Social needs, we aspire more for status and then our ultimate goal of life for self-fulfillment and being out of the rat race of the world.

So that’s a brief about Maslow’s hierarchy and let’s see how a similar hierarchy exists for financial needs as well.

At first in the Financial Survival stage, you need to pay for all the things that you need to survive. If you have to use debt to do that, it doesn’t matter because you need to buy food to stay alive so that’s what you do.

This is the most exploited stage which benefits the rich and crushes the back of the forgotten tribe which counts for almost 29%-30% of Indian population. Aamdani athanni, kharcha rupaiyaa…

Jan dhan yojna, Ayushman Bharat and the likes try to inculcate Financial Inclusion, however our country cannot attain The Developed Nation status till we uplift the financial status of this forgotten tribe.

For Financial Stability, you’ll need to make enough money to pay all your expenses. You could live quite happily at the Sustainability level for a while but you’re not necessarily safe there.

This is the most unstable stage and one small injury or unexpected expense could derail everything, saalo ki mehnat paani mein.

This is the stage where one needs to ask questions about sustenance and thus the concept of Insurance. Man is a fearful animal and likes to shun away from risks. In this unstable stage, our decisions on transfer of risks will decide our whole life and future of our loved ones.

This is the most unstable stage in entire Financial Hierarchy of needs and intelligent allocation of hard-earned money can take you to the next higher level, on the other side, foolishness leads you to the snake’s mouth and down to the Survival stage, which we call as being Uninsured or Inadequately Insured. Saap sidi ka khel hai bhai…Kabhi upar to kabhi niche…

Many would have heard or spoken, “Mahine ke akhir me kuch bachta hi nahi”. Reaching Accumulation stage may itself be a big achievement for many and without Risk transfer i.e. Insurance it seems quite impossible.

Finally, if you reach this stage, you make more than you spend so you are able to save for future unplanned expenses. On this stage, concept of Investment kicks in. Bachat se Nivesh tak ka phase.

Accumulation stage has its own vices and you can get pulled towards fancy scheme of investments like purchasing an unrequired Farmhouse, delaying appreciation of assets, fixed return products which gets eaten up by inflation.

Right questions at this stage can carry you to the high-level nirvana stages and poor decisions can once again lead you to the snake’s mouth. Kam paise mein khushi difficult hai par zyaada mein impossible…

The next level is Independence, the stage of Azaad Parinde. Since it’s unlikely you will be physically able to work your entire life, you eventually need to get to the point where you can pay all your expenses without working.

Excluding the born rich, without Insurance & Investments, this stage is not less than a fairy tale for almost the entire mankind, no offence to women, I meant humankind…

Finally, you reach the pinnacle, The Legacy phase. This is when you know you’ll never run out of money so your sole financial focus is aligning your spending and giving to society, charities, heirs, etc. And the famous saying says, ‘Unke paas to itna hai ki saat pushtein khayenge to bhi kam nahi hoga’

The Hierarchy of Financial Needs shows us the mirror and forces us to ask the right questions to ourselves…

- · Which stage are we in? Mine is in the Accumulation Stage…Aur daud zaari hai Azaad Parinde banne ke liye…

- · What it takes to attain Financial Independence?

- · Is it possible for me to become Financially Independent without Insurance & Investment? Koi Shakk…

- · When will I come out of 9-6 job circle?

Congratulations, you have crossed the first Financial stage as you read the entire article and reached here…

Now as you start your Financial Temple run, start collating Questions on Insurance & Investments.

As stated in the beginning of the chapter, let’s ask at least 20 questions for each subset of Insurance & Investment as we progress on the hierarchy of our Financial journey…till we meet in the next article…Namaste and Godspeed towards Financial Stability…

#motivation2insure #getinsured

Keyur Gandhi

Clarion Insurance Broking Services Pvt. Ltd.

M: +91 98254 04014, +91 99308 74014