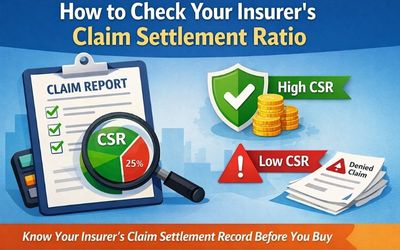

When purchasing insurance, most people focus heavily on premium costs and coverage features while overlooking one of the most critical factors: how likely the insurer is to actually pay claims when you need them. This is where understanding claim settlement ratio becomes essential. This simple yet powerful metric reveals which are the reliable insurers that honour their commitments versus those with questionable track records of claim denials.

|

High rank keywords |

claim settlement ratio |

reliable insurers |

best claim record |

|

Medium rank keywords |

check insurance company performance |

settlement success |

|

|

Low rank keywords |

insurer research tips |

claim ratio meaning |

|

When purchasing insurance, most people focus heavily on premium costs and coverage features while overlooking one of the most critical factors: how likely the insurer is to actually pay claims when you need them. This is where understanding claim settlement ratio becomes essential. This simple yet powerful metric reveals which are the reliable insurers that honour their commitments versus those with questionable track records of claim denials.

The best claim record doesn't happen by accident—it reflects an insurer's financial stability, operational efficiency, customer-centric approach, and ethical business practices. Learning how to check insurance company performance through claim settlement data empowers you to make informed decisions based on actual payout history rather than marketing promises. After all, insurance delivers value not when you purchase it, but when claims are settled fairly and promptly.

By understanding how to evaluate insurers' claim track records systematically, you'll select coverage from companies proven to support policyholders when it matters most.

Understanding Claim Ratio Meaning: What the Numbers Tell You

Before learning where to find claim settlement data, it's crucial to understand exactly what claim settlement ratio means and what it reveals about reliable insurers.

Claim settlement ratio represents the percentage of claims an insurance company approved and paid during a specific period (typically a financial year) out of the total claims received. The formula is straightforward:

Claim Settlement Ratio = (Number of Claims Settled / Total Claims Received) × 100

If an insurer receives 10,000 claims in a year and settles 9,500 of them, its claim settlement ratio is 95%. This percentage immediately indicates settlement success likelihood—higher ratios generally suggest reliable insurers are more likely to honour legitimate claims.

However, understanding claim ratio meaning requires nuance. A 98% settlement ratio sounds better than 92%, but the full picture involves multiple factors. The 92% company might handle more complex cases or maintain stricter quality standards, while the higher-ratio company might avoid difficult cases or have simpler product portfolios.

Health insurance settlement ratios typically run slightly lower than life insurance due to the higher volume and complexity of claims. Ratios between 85-95% are common for health insurers, though the best claim record companies consistently exceed 90%.

General insurance (motor, home, etc.) settlement ratios vary widely based on policy types and claim complexities. Understanding these category-specific norms helps you evaluate whether a particular ratio indicates strong or weak settlement success.

Where to Find Official Claim Settlement Data

The good news about checking insurance company performance is that authentic claim settlement data is publicly available through official regulatory sources, making insurer research tips accessible to every consumer.

1. IRDAI Annual Reports: The Primary Source

The Insurance Regulatory and Development Authority of India (IRDAI) publishes comprehensive annual reports containing claim settlement ratios for all registered insurers. These reports represent the most authoritative source for evaluating reliable insurers based on actual performance data.

2. Individual Insurer Annual Reports

Insurance companies also publish their own annual reports, available on their websites, which include claim settlement statistics. While these self-reported numbers should match IRDAI data, company annual reports often provide additional context—breakdown by policy type, geographic distribution, average settlement time, and explanations for any performance variations.

Reviewing insurer annual reports supplements IRDAI data by providing deeper insight into settlement success patterns. However, treat company-published statistics as supplementary to official regulatory data rather than primary sources, as selective presentation might emphasise favourable aspects.

3. Financial News and Insurance Publications

Financial newspapers, insurance industry magazines, and specialised websites regularly publish articles analysing claim settlement performance, particularly when the annual IRDAI reports are released. These analyses often provide valuable context, highlighting notable performers and explaining trends in settlement success across the industry.

While these secondary sources don't replace checking official data, they offer expert interpretation, helping you understand claim ratio meaning in a competitive context—whether a 93% ratio represents strong performance or indicates concerns, depends partly on industry-wide averages that expert analysis illuminates.

How to Interpret Claim Settlement Ratios Correctly

Finding claim settlement numbers represents only the first step in identifying reliable insurers. Proper interpretation requires understanding what these percentages truly indicate and their limitations.

1. Higher Isn't Always Better

While generally higher claim settlement ratios suggest reliable insurers, exceptionally high ratios—say, 99.5% or above—warrant scrutiny. Such figures might indicate:

l Extremely conservative underwriting that accepts only the lowest-risk customers

l Avoidance of complex or marginal cases that raise legitimate coverage questions

l Very small claim volumes where statistics might be less meaningful

l Product portfolios dominated by simple, low-value policies with straightforward claims

The best claim record balances high settlement rates with reasonable underwriting standards and diverse product offerings. A 97% ratio from an insurer handling complex cases across varied demographics might indicate a stronger ethical commitment than a 99% ratio from one serving only extremely low-risk groups.

2. Compare Within Categories

When checking insurance company performance, compare like with like. Life insurance settlement ratios shouldn't be directly compared to health or motor insurance ratios, as claim characteristics differ fundamentally.

This categorical approach to evaluating settlement success provides meaningful benchmarking rather than misleading cross-category comparisons.

3. Consider Claim Volume

Settlement ratio percentages gain significance from the claim volume context. An insurer with a 98% ratio from 500 claims differs from one achieving 98% across 50,000 claims. Higher volumes generally indicate more reliable statistics, though both operational capacity and statistical significance improve with scale.

Check the absolute number of claims alongside percentages when determining reliable insurers. An insurer settling 95% of 100,000 claims demonstrates proven capability in handling volume while maintaining high settlement success—potentially more reassuring than 98% of 5,000 claims.

4. Trend Analysis Matters

Don't evaluate insurers solely on a single year's claim settlement ratio. Check insurance company performance across multiple years to identify trends. Consistent ratios year-over-year suggest reliable operational standards, while volatile ratios might indicate management instability or operational challenges.

If an insurer's settlement ratio dropped from 96% to 88% over two years, investigate why. Were there regulatory actions, management changes, or shifts in business focus? Understanding trends provides deeper insight than isolated percentages.

Practical Application: Making Informed Insurer Selection

Understanding how to check claim settlement ratios means nothing without applying this knowledge to actual insurance purchase decisions.

l Create a Comparison Framework

l When evaluating multiple insurers, create a simple spreadsheet comparing:

l Claim settlement ratio (latest year and 3-year average)

l Total claims handled (volume)

l Claim settlement time (if available)

l Solvency ratio

l Premium quote for your specific coverage needs

l Network coverage (for health/motor insurance)

l Customer review sentiment

This structured approach to checking insurance company performance prevents decision-making based solely on premium costs or a single metric, ensuring you identify genuinely reliable insurers.

Weigh Claim Performance Appropriately

While claim settlement ratio matters significantly, balance it against other factors. An insurer with a 94% ratio charging ₹15,000 for coverage might deliver better overall value than one with 97% charging ₹25,000, depending on your budget and risk tolerance.

However, never compromise excessively on settlement success for premium savings. The cheapest policy proves worthless if claims get rejected—the entire purpose of insurance is receiving payouts when needed.

Seek Professional Guidance When Needed

If researching reliable insurers feels overwhelming, consult independent insurance advisors who can interpret claim settlement data, explain claim ratio meaning in your specific context, and recommend insurers balancing strong settlement success with appropriate coverage and pricing.

Ensure advisors you consult maintain independence rather than selling for specific companies with biased recommendations. Fee-based advisors often provide more objective guidance than commission-based agents.

Prioritise Claim Performance for Critical Coverage

For essential coverage like health and life insurance protecting your family's financial security, prioritise the best claim record, even if it costs moderately more. For lower-stakes coverage like specific consumer electronics insurance, slightly lower settlement ratios might be acceptable if premiums are significantly cheaper.

This tiered approach to settlement success importance helps optimise insurance spending while ensuring critical protections come from proven, reliable insurers.

Staying Updated on Insurer Performance

Claim settlement ratios change annually. Insurers improving operations might boost settlement success, while others might decline. Staying informed about changing insurance company performance helps with renewal decisions and ongoing portfolio optimisation.

Set annual reminders to check updated IRDAI reports when they release, typically around mid-year. Compare your current insurer’s latest ratios against competitors—if your insurer's settlement success has declined significantly or competitors show substantially better performance, consider switching at renewal.

Many insurance comparison platforms offer newsletters or alerts about industry developments including claim settlement trends. Subscribing to such updates keeps you informed without requiring active research.

Consumer advocacy organisations and financial planning websites regularly publish analyses of claim settlement data when the IRDAI reports are released. Following such sources provides interpreted insights beyond raw statistics.

Conclusion: Empowered Insurance Decisions Through Data

Learning how to check your insurer's claim settlement ratio transforms insurance purchasing from a leap of faith into an informed decision based on verified performance data. Understanding claim ratio meaning, knowing where to find authentic settlement success statistics, and properly interpreting this data identifies reliable insurers worthy of your trust and premium payments.

The best claim record companies earn their reputations through consistent settlement success across years, transparent processes, customer-centric approaches, and financial stability. By systematically checking insurance company performance using the insurer research tips in this guide, you position yourself to select insurers that will stand by you when claims arise—which is, after all, insurance's entire purpose.

Remember that while claim settlement ratio provides crucial insight, a comprehensive evaluation considers multiple performance dimensions. Balance settlement success data with premium competitiveness, network coverage, customer service quality, and your specific coverage needs for optimal insurance decisions.