The Questions Series… Chapter: 3, Kyon Health Insurance Zaroori Hai? This happens only in Insurance... Our Insurance Salesman says, ‘Jimmy Jimmy Jimmy….ajaa ajaa ajaa…’ & Our Prospective Client says, ‘Nahin nahin, abhi nahin….thoda karo intezaaaar….’ And the story continues….

This happens only in Insurance...

Our Insurance Salesman says, ‘Jimmy Jimmy Jimmy….ajaa ajaa ajaa…’

&

Our Prospective Client says, ‘Nahin nahin, abhi nahin….thoda karo intezaaaar….’

And the story continues….

Country of 1.4 billion requires a Pandemic to answer the question, ‘Kyon Health Insurance Zaroori Hai?

During the pandemic when all industries registered negative or miniscule growth, Retail Health Insurance sector produced a mammoth 40% growth rate.

Thus it proves, when house is on fire, run for water…

Government, knowing negligible penetration of Health Insurance, had to intervene and request Insurance companies to launch a special edition of Health Insurance specifically addressing Covid-19 in avatar of Corona Kavach & Corona Rakshak.

These products eventually had to be withdrawn by almost all companies citing suicidal loss ratios.

Kitna deti hai? An usual question asked by Indians while purchasing cars was literally used while purchasing Corona related policies and Policy holders struck gold by severely utilizing the benefits of these policies.

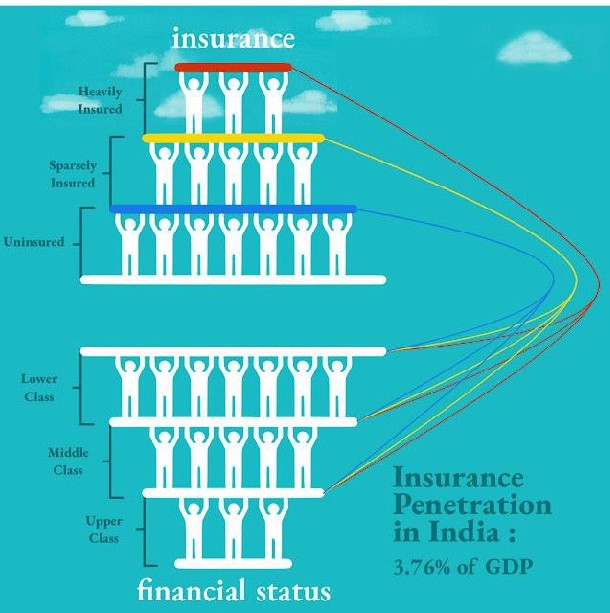

India can be divided into Lower, Middle and Upper classes based on their financial status, however in Insurance parlance we can divide Indians into Heavily Insured, Sparsely Insured & Uninsured.

India is highly under penetrated with regards to Insurance and Financial status doesn't guarantee adequacy of Insurance. (In 2019, India's life insurance penetration stood at around 2.82 percent, while the non-life insurance penetration was much lower at 0.94 percent. The overall penetration for the industry was 3.76 percent in 2019)

Guys who belong to Upper strata and/or Heavily Insured have already attained peace of mind. Upper strata have a pool of funds to service their health/ life hazards & adequately insured gentlemen's insurance policies will service all their Health, Assets, Life insurance claims.

Sparsely Insured are the folks who got trapped or convinced by our superman insurance salesmen and have some relevant insurance policies to service their present and future insurance needs.

Uninsureds are those who either belong to Lower or Middle class on financial ladder and skip insurance for Roti, Kapda aur Makaan or have a mindset of being God's immortal soldiers sent to this world who don’t need any blessing from Insurance God. On a lighter note few are those forgotten people who are and will be never approached by Insurance Sales force considering that, ‘yeh to kabhi bhi nahi lega….’

To understand Health Insurance Kyon Zaroori Hai, we need to understand Health Financing which may help us get convinced on this topic.

The core purpose of health financing is to make funding available and ensure that our family gets access to effective healthcare as and when need arises.

In most of the developed countries, Health care is free for their citizens and individuals don’t need to worry much about managing finances themselves.

However in India, although with the advent of Ayushman Bharat, we still have to worry ourselves about our own Health wellbeing.

As we built our assets like Home, Office, Jewelry, Bank balance we also have to be mindful of Healthcare expenses which either can be funded through Health Insurance or a separate pool of funds to service future Health care expenses.

Upper Class who has loads of money to take care of their generations are little or not at all worried about insurance needs. But if readers belong to the Middle or Lower class based on Financial status, they should have all reasons to become learned about insurance and most importantly Health Insurance.

This brings me to list down the most important reasons on Kyon Health Insurance Zaroori Hai…

Rising Medical Cost:

The medical costs have dramatically risen lately. During this pandemic even our Kids learnt about medicines which were difficult to even pronounce just because of their exorbitant costs. As medical technology improves and diseases increase, the cost for treatment rises as well. And it is important to understand that medical expenses are not limited to only hospitals. The costs for doctor's consultation, diagnosis tests, ambulance charges, operation theatre costs, medicines, room rent, etc. are also continually increasing. All of these could put a considerable strain on our finances if we are not adequately prepared.

By paying a relatively affordable health insurance premium each year, we can beat the burden of medical inflation while opting for quality treatment, without worrying about how much it will cost us.

Changing Lifestyle:

The tectonic shift in our lifestyle has made us more prone to a wide range of health disorders. Commuting, hectic work schedules, wrong eating habits, quality of food, and rising levels of pollution have increased the risk of developing health problems.

The new acronym WFH has further declined our health stability. Illnesses like diabetes, obesity, respiratory problems, heart disease, all of which are prevalent among the older generation, are now rampant in younger people too.

While following precautionary measures can help combat and manage these diseases, an unfortunate incident can be challenging to cope with, financially. Opting for Investing in a health plan that covers regular medical tests can help detect these illnesses early and make it easier to take care of medical expenses, leaving us with one less thing to worry about.

Financial stability:

While an unforeseen illness can lead to mental anguish and stress, there is another side to dealing with health conditions that can leave us drained – exorbitant medical expenses.

By buying a suitable health insurance policy, we can better manage our medical expenditure without dipping into our savings. In fact, some insurance providers offer cashless treatment, so we don't have to worry about reimbursements either. Our savings can be used for their intended plans, such as buying a home, our child's education and retirement.

Income Tax Benefit:

Additionally, health insurance lets us avail tax benefits, which further increases our savings.

Key points on Tax benefits through Health Insurance

· Payments made towards health insurance premiums are eligible for tax deductions under section 80D of the Indian Income Tax Act.

· Individuals up to 60 years of age can claim a deduction of up to ₹ 25,000 for the health insurance premium paid for themselves, or for their spouse or children.

· One can also claim another ₹ 50,000 as deduction if we buy health insurance for our parents aged 60 years and above.

Peace of Mind:

Ultimate aim of buying Insurance is to attain peace of mind. One part of our mind is always thinking about our near and dear ones 24*7 as we care for them. We purchase anything and everything demanded by our family to comfort them no matter what it takes.

Buying Health Insurance is actually buying happiness for our families.

I would suggest all readers to experiment peace of mind by opting for Health Insurance. Am sure each one of us will attain Happiness and Peace of Mind through securing our family with Health Insurance.

I leave you with a song which was being played by Alexa while I wrote this blog…

Yunhi kat jaayega safar saath chalne se

Ke manzil aayegi nazar saath chalne se

Hum hain rahi pyar ke chalna apna kaam

Palbhar mein ho jaayegi har mushkil nakaam

Hausla na haarenge

Hum toh baazi maarenge

Health Insurance Zaroori Hai...

Do explore Health Insurance Options…. Hasta La Vista…